News

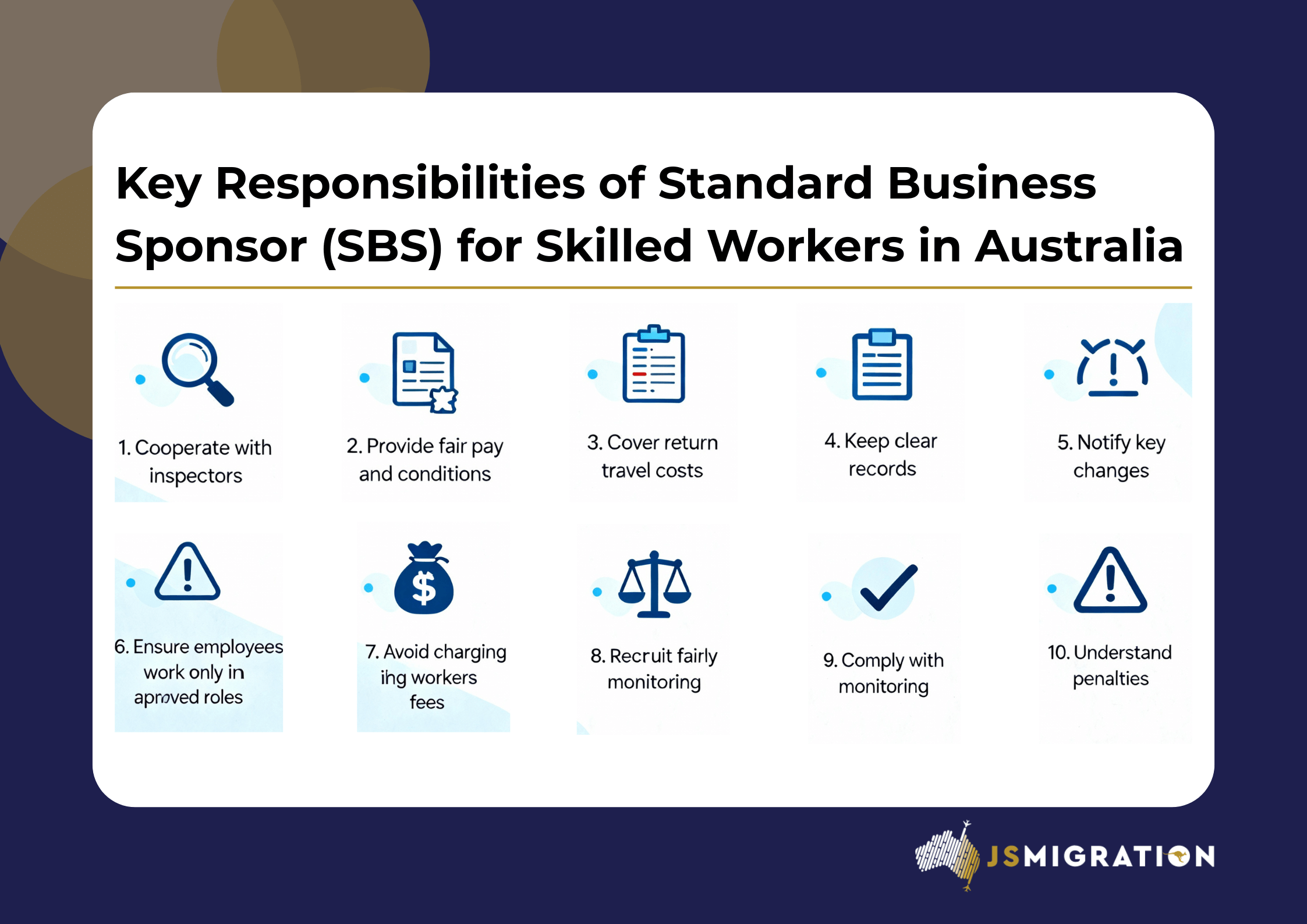

Sponsoring skilled workers through programs like the Temporary Skill Shortage (subclass 482) or Skilled Employer Sponsored Regional (subclass 494) means you have important obligations. These rules protect both Australian workers and your overseas hires and keep the sponsorship process fair and transparent.

In this post, we’ll outline the key legal obligations you need to understand before sponsoring your first skilled migrant employee. Knowing these requirements early helps your business stay compliant and ensures a smoother sponsorship process from start to finish.

Cooperate with Inspectors — Stay Ready

Expect visits or requests from Department of Home Affairs (DOHA) inspectors or other agencies. They might want to look at your records or speak with staff to check compliance. This oversight starts when your sponsorship is approved and lasts up to five years after it ends.

Fair Pay and Working Conditions — Treat Everyone Equally

Your sponsored employees should never be paid less or treated worse than their Australian counterparts in the same role. Their wages must match what you nominated, and working conditions should be equal or better—unless their income is above $250,000 per year, then some exceptions apply.

Cover Return Travel Costs — Helping Workers Go Home

If a sponsored worker (or their family) requests in writing to return to their home country, you’re responsible for reasonable travel expenses. This usually means economy flights back home.

Government Costs — Be Accountable if Workers Overstay

If the government must track down and remove a sponsored employee who overstays, your business might have to repay those removal costs—up to $10,000.

Keep Clear Records — Paperwork Matters

Maintain thorough and verifiable records, including employment contracts, job duties, business turnover for levies, and any training benchmarks if relevant. Keep everything for at least five years in case DOHA asks to review them.

Provide Information When Asked — Respond Promptly

When the Minister or DOHA asks for information or documents, reply within the timeframe specified to avoid issues.

Notify DOHA About Important Changes — Keep Them in the Loop

Within 28 days, inform DOHA if an employee stops working for you, changes roles, or if there are changes in business ownership, insolvency, or your contact details.

Sponsored Employees Must Stick to Approved Roles — No Side Gigs

Workers should only perform the duties listed in their approved nomination. They must be directly employed by you or your associated company — not loaned out to others.

Don’t Shift Sponsorship Costs to Employees — You Cover It

You cannot charge your sponsored workers any fees for sponsorship, visa processing, recruitment, or government levies. These remain your obligation as the employer.

Recruit Fairly — No Discrimination Allowed

Use visa programs only to fill genuine skill shortages after checking for suitable Australian candidates. Recruitment should always be nondiscriminatory, regardless of nationality or visa status.

Compliance Checks and Monitoring — They’re Watching

DOHA regularly monitors sponsors through document requests, site visits (often unannounced), and data sharing with agencies like the ATO or Fair Work Ombudsman.

Penalties for Non-Compliance — Serious Consequences

Failing to meet your obligations can lead to sponsorship suspension, cancellation, future bans, public naming, fines up to $63,000 per breach, or even legal action.

💡 Need Help Navigating Your Sponsorship Duties?

Understanding these rules might feel overwhelming, but you don’t have to face it alone. If you receive monitoring requests or want to double-check your compliance, contact JS Migration right away. Acting early can save you from bigger problems down the line.

POSTED: 13 Nov, 2025

View all news